Research Publications

Smart Home Technology: Many Express Interest, But Cost and Privacy Concerns Slow Adoption

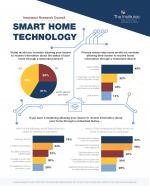

Smart Home Technology: Many Express Interest, but Cost and Privacy Concerns Slow Adoption, This study finds that nearly half of all homeowners and renters countrywide would consider allowing their insurance company to receive information about the status of their home through a smart home device or system. The study also identified attitudes and concerns that discourage some from participating in programs involving insurers.

Public Understanding of Hurricane Deductibles: Need for Consumer Education Persists

This report examines public understanding of the nature and effects of hurricane deductibles and other special deductibles applicable to storm-related homeowners insurance claims. The study is based on a survey of privately-insured homeowners in five coastal states.

Third-Party Bad Faith in Florida’s Automobile Insurance System

Bad-faith lawsuits targeting automobile insurers in Florida impose a heavy burden on the state’s auto insurance system and auto insurance consumers. This report examines the effect that potential bad-faith settlements have on underlying claiming behavior in Florida. Estimates of additional claim costs attributable to the bad-faith legal environment are included.

Expert Views of Auto Insurance Rate Regulation

This report surveys academic experts in risk and insurance on the effectiveness of prior approval and market-oriented rate regulatory policies in automobile insurance. The results show that a vast majority believe the prior-approval regulation of auto insurance rates is unnecessary and does not benefit consumers.

The Long-Term Effects of Rate Regulatory Reforms in Automobile Insurance Markets

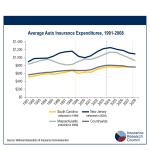

This study provides evidence of the positive impact of relaxing stringent rate regulations in the automobile insurance markets of South Carolina (reformed in 1999), New Jersey (reformed in 2003), and Massachusetts (reformed in 2008). Estimates show that rate reforms have led to a number of positive developments in these markets without leading to increases in insurance prices or reductions in insurance availability. Overall, the regulatory reforms in these states have improved the performance of the insurance market for both consumers and insurers.

The Impact of First-Party Bad-Faith Legislation on Key Insurance Claim Trends in Washington State

According to a new study from the Insurance Research Council (IRC), evidence suggests that legislation adopted by the Washington State Legislature in 2007 and approved in a statewide voter referendum may have caused an increase in homeowners insurance claim costs in the state. It is estimated that claim costs were as much as $190 million greater than they otherwise would have been in the two-year period following the law’s enactment. The Insurance Fair Conduct Act, commonly referred to as R-67, eased restrictions for aggrieved insurance claimants filing lawsuits alleging bad faith against their own insurance companies, and authorized the payment of virtually unlimited punitive damages to bad-faith claimants, in addition to the payment of actual damages, attorneys’ fees, and court costs.

Public Support For Laws and Devices That Promote Highway Safety

The first issue of the Insurance Research Council’s Public Attitude Monitor 2007 (PAM) analyzes public opinion on a range of issues related to highway safety and traffic enforcement.

- Purchase PDF ()

- Purchase Printed ()

- View News Release

Consumer Attitudes Toward Information Sharing Between Businesses

This report summarizes findings from initial quantitative and focus group research completed in 2000, and explores the issue of information sharing in context of the tradeoff between strict protection of consumer information and the benefits that result from allowing businesses to share customer information within and between companies.

- Purchase PDF ()

- Purchase Printed ()

- View News Release

Business Attitude Monitor 2000

The 2000 edition surveyed firms with annual sales volume of between $5 million and $125 million about their attitudes toward the deregulation of commercial lines rates and forms and their satisfaction with various aspects of their insurance experience.

- Purchase PDF ()

- Purchase Printed ()

- View News Release

Homeowners Loss Patterns in Eight Cities

This study demonstrates the variations in homeowners insurance loss experience across and within eight major U.S. cities and the communities within five miles of the cities' boundaries. The eight urban areas included in the study are Chicago, Detroit, Los Angeles, Milwaukee, New York City, New Orleans, Philadelphia, and St. Louis. The report provides detailed information on claim counts and dollar losses by six major causes of loss - fire, lightning and removal; liability and medical; wind and hail; water and freezing; theft; and all other causes of loss.

- Purchase PDF ()

- Purchase Printed ()

- View News Release