Research Publications

Public Perceptions Regarding the Fairness of Insurance Rating Factors

This report examines differences in public opinions of fairness of the various rating factors used to price Homeowners and Personal Auto insurance. It also looks at consumer perceptions of personal insurance accessibility.

Report Summary:

Auto Insurance Telematics: Consumer Attitudes and Opinions, 2022 Edition

This report expands on previous IRC research on consumer attitudes and opinions with respect to personal auto insurance telematics and usage-based insurance (UBI). The report finds that more U.S. drivers are open to opting into UBI programs to save on their auto insurance premiums. Yet, more widespread acceptance of telematics programs and UBI remains limited for various reasons, including privacy concerns. Findings also confirm that Telematics programs provide the opportunity for safe drivers to lower their insurance costs and can improve overall road safety.

Report Summary:

Public Opinions on Credit Scoring and the Use of Credit-Based Insurance Scores

The focus of this study is the public’s knowledge of and attitudes on issues around credit history, credit scores, and the use of credit-base insurance scores as an insurance rating factor. It also looks at perceptions of auto insurance affordability. The results are based on an online survey with more than 7,000 respondents.

Report Summary:

Public Attitudes on Litigation Trends and the Role of Attorneys in Auto Insurance Claims

This study examines public attitudes on issues around litigation and the impact on insurance. Through an online survey with more than 1,500 respondents, the Insurance Research Council examined consumer perceptions of attorney advertising, litigation financing, the role of attorneys in insurance claims, and issues relating to personal injury lawsuits. One focus of the report is generational differences in attitudes toward these topics.

Report Summary:

Consumer Responses to the Pandemic and Implications for Insurance

This study reports the findings from an October 2020 survey examining changes in commuting patterns, changes in personal risk exposure, and other topics related to the COVID-19 pandemic and its economic effects. Many of the impacts were more commonly reported among younger, urban, and lower-income respondents.

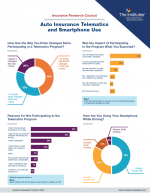

Auto Insurance Telematics & Smartphone Use: Consumer Survey Report

This report explores consumer attitudes and opinions with respect to auto insurance telematics and usage-based insurance. The report finds that many drivers participating in the programs change their driving behavior in response to information provided by their insurance companies about their driving gathered with a telematics device. The report also confirms that many drivers are concerned about the privacy of their personal information.

Attitudes on Home and Vehicle Ownership

This report summarizes findings based on a recent survey conducted on behalf of the IRC regarding

personal auto, homeowners, and renters insurance. The survey sample of 2,000 adult respondents was

representative of the United States’ general population with respect to age, gender, income, and region.

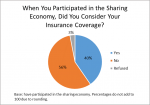

The Sharing Economy: Public Participation and Views

This study examines public familiarity with and participation in the sharing economy. Also explored in the report are various insurance-related aspects of the sharing economy. The study is based on the responses of 1,105 participants in a survey fielded by GfK Public Affairs & Corporate Communications.

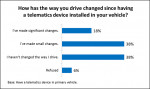

Auto Insurance Telematics: Consumer Attitudes and Opinions

The report explores consumer attitudes and opinions with respect to auto insurance telematics and usage-based insurance (UBI). The report finds that many drivers participating in telematics programs change their driving behavior in response to information provided by their insurance companies about their driving that was gathered with a telematics device. The report also confirms that many drivers are concerned about the privacy of their personal information.

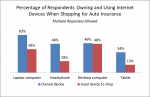

Shopping for Auto Insurance and the Use of Internet-Based Technology

This report examines how often consumers shop for auto insurance, how they go about shopping, the choices made after shopping, satisfaction with the shopping experience, and the use of Internet-based personal technology when shopping for insurance. The report also looks at differences in shopping behavior and technology use across demographic groups