Research Publications

Trends in Personal Auto Insurance Claims: 2002–2022

This update to the IRC’s longstanding Trends in Auto Claims series examines two decades of frequency, severity, and average loss costs for three vehicle damage coverages and two auto injury coverages. It also documents the claims impact of the COVID-19 pandemic. Both countrywide and state-level results are presented.

Report Summary:

Countrywide Patterns in Auto Injury Claims

This closed claim study is based on a sample of more than 80,000 auto injury claims paid in 2017 and examines trends in claim patterns, including injuries, medical treatment, claimed losses and payments, the claim settlement process, and attorney involvement. The report compares 2017 data to results from similar studies conducted in 2012 and earlier.

Motivation for Attorney Involvement in Auto Injury Claims

This study examines the role of attorneys in the process of settling auto injury claims. In an on-line survey, respondents injured in auto accidents were asked about their experience, including satisfaction with the claim process, their decision whether to talk to or hire an attorney, and the services provided by attorneys.

Affordability in Auto Injury Insurance: Cost Drivers in Twelve Jurisdictions

Affordability in Auto Injury Insurance: Cost Drivers in Twelve Jurisdictions, June 2016, 132 pages.

This study identifies and documents the common and unique factors and conditions underlying rising auto injury insurance claim costs in 12 jurisdictions (Delaware, District of Columbia, Florida, Kentucky, Louisiana, Michigan, Mississippi, Nevada, New Jersey, New York, Rhode Island, West Virginia).

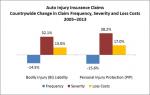

Trends in Auto Injury Claims, 2015 edition

This report examines the frequency, severity and loss costs associated with auto injury insurance claims under bodily injury liability and personal injury protection coverages, from 1990 to 2013. Countrywide and individual state outcomes and trends are analyzed.

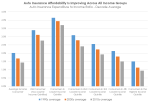

Trends in Auto Insurance Affordability

This report monitors auto insurance affordability across states and over time using the IRC’s auto insurance expenditure-to-income ratio. The study also analyzes auto insurance affordability trends for low-to-moderate income consumers and inspects differences in affordability trends across various goods and services considered necessities.

Attorney Involvement in Auto Injury Claims

This report uses data from the 2012 closed claim study to examine trends in the rate of attorney involvement in auto injury claims over time and across states. It also provides details on the interaction between the presence of attorneys and cost drivers such as medical treatment and claim abuse and looks at how represented claimants fare compared to claimants without attorneys with respect to claim payment and time to settlement.

Auto Injury Insurance Claims: Countrywide Patterns in Treatment, Cost and Compensation, 2014 Edition

This publication shows dramatic increases in claimed medical expenses and examines some of the factors driving them. The closed claim study, the seventh of its kind conducted by the IRC, is based on a sample of more than 35,000 auto injury claims paid in 2012. The study examines trends in claim patterns, including details on injuries, medical treatment, claimed losses and payments, attorney involvement, and fraud.

Auto Insurance Affordability

This report presents a new methodology for studying automobile insurance affordability and examines changes and differences in affordability over time and across states. The study also inspects the drivers of automobile insurance affordability.